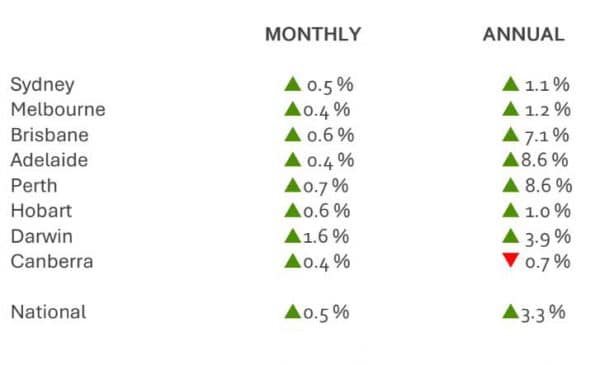

Cotality’s June 2025 Housing Value Index confirms the heat has come out of Australia’s residential market, without freezing momentum. National dwelling values rose 0.5 per cent through May, lifting the index 1.3 per cent over three months and 3.3 per cent over the past year.

While growth continues, the numbers highlight a welcome moderation after 2023-24’s rapid upswing.

The picture is far from uniform. Perth remains the standout capital, powered by lean listings and strong migration. Adelaide and Brisbane also advanced, whereas Sydney and Melbourne edged higher by only a few tenths as deeper inventories gave purchasers more leverage. Canberra drifted, while Hobart and Darwin held steady. Such diversity shows that local supply, employment, and migration patterns now outweigh blanket interest-rate effects.

Regional markets tell a similar story. The combined ‘rest-of-state’ index inched 0.4 per cent higher, with gains centred on coastal Queensland and Western Australia. Inland centres once buoyed by the work-from-anywhere boom have largely plateaued. This gentler rhythm may benefit entry-level buyers willing to commute or embrace hybrid work, yet competition for well-kept homes remains brisk where stock is scant.

Affordability stays front-of-mind. Though the Reserve Bank’s May cut pared variable mortgage rates, lenders’ serviceability buffers limit borrowing power. Advertised supply is about 15 per cent below the decade average, so each new listing attracts more bidders than usual. Aspiring buyers should secure full pre-approval and set realistic walk-away prices to avoid budget blow-outs

Cotality estimates a median-income household now typically needs a 9.2-year effort to assemble a 20 per cent deposit for a capital-city dwelling, down marginally on 2024 yet still well above the long-term norm. This helps explain why shared-equity and smaller-deposit guarantees continue to attract strong enquiry.

Established owners face mixed fortunes. Households that purchased before the late-2024 soft patch have regained equity and a safety net. Those rolling off ultra-low fixed loans confront higher repayments; many are funnelling surplus cash into principal reductions rather than pulling equity for non-essential spending. Renovation activity remains robust as families choose to improve rather than trade, which could cap fresh listing volumes for some time.

First-home buyers, however, have reasons for optimism. Softer conditions in Sydney’s and Melbourne’s fringe suburbs keep asking prices steady, and expanded federal and state purchase-assist schemes are trimming deposit hurdles. Buyers prepared to look to smaller capitals or lively regional hubs will find lower entry prices and less aggressive auctions, though diligence on building condition and future infrastructure remains vital.

For homeowners weighing an upgrade, today’s flatter trajectory offers a rare moment to trade-up without chasing runaway prices. A clear budget, professional valuation and a contingency buffer for unexpected rate movements are prudent safeguards.

The bottom line is that Australia’s housing market is still advancing, yet at a pace consistent with sustainable household finances. Patience, preparation and local insight have seldom been more valuable to both seasoned owners and newcomers alike.

Monthly change in capital city home values